You informed on your own it was short-term. Simply a quick fix to survive a rough patch. Now, the installment-based cash loan strategy you as soon as viewed as a lifeline has actually developed into a monetary chokehold. Regardless of how many repayments you make, the balance hardly relocates. The financial debt clings to you, tightening up like a noose.

At first, it felt convenient. The repayments were small, predictable. But after that came the costs. The passion. The sneaking awareness that what began as a temporary option had morphed into a nonstop drain on your financial resources. You function, you pay, yet the debt simply sits there-- teasing you.

You're not the only one. These financings are made to maintain you paying. The lenders recognize precisely what they're doing. They make it very easy to borrow yet virtually impossible to run away. And the most awful part? The tension isn't almost the cash-- it's the exhaustion, the pity, the continuous background sound of monetary concern.

Yet here's the reality: you can go out. There's real relief from installment-based cash loan plans, and you don't have to face this alone. It won't occur overnight, however the cycle can be damaged. Let's speak about just how.

The Concealed Catch of Installment-Based Cash Advance Program

Externally, these finances feel like a true blessing. Rather than paying whatever back at once-- like a cash advance-- you reach spread out the price gradually. Monthly, biweekly, or whatever schedule they establish. It really feels a lot more affordable. Much more responsible.

That's the lie.

The truth is that installment-based cash advances are developed to maintain you locked in financial debt for as long as possible. They hang reduced regular monthly settlements in front of you, all while hiding you under sky-high rates of interest and limitless fees. Some lending institutions even structure repayments to make sure that the initial few months barely touch the principal. It's a system constructed to bleed you completely dry.

And if you fall behind? That's when things obtain really awful.

Late costs accumulate quick, making it more difficult to catch up.

Collection calls beginning coming, including anxiety and stress and anxiety to your life.

Some lending institutions even threaten lawsuit, making you seem like you're drowning without any escape.

It's tiring. It's infuriating. And worst of all, it can make you seem like you're stuck forever.

The Psychological Toll: It's More Than Just Money

Financial debt isn't nearly numbers. It seeps into every little thing-- your relationships, your sleep, your capacity to concentrate. It's that pit in your stomach every time you examine your balance. The dread when one more expense arrives. The embarassment of sensation like you're constantly behind.

Possibly you have actually quit addressing unidentified phone calls, terrified it's one more enthusiast. Maybe you've had minutes where you thought about avoiding a dish, simply to make certain the repayment gets rid of. Possibly you're tired of clarifying to friend or family why you still can not capture a break.

And the most awful part? The sense of guilt. The sensation that you need to've seen this coming. That you must've done something differently.

However pay attention-- this isn't your fault. These financings are developed to trap people who are currently battling. They're improved the hope that you'll remain desperate. That you'll maintain paying just to maintain your head above water.

You don't have to play their game any longer.

Exactly How to Discover Actual Relief from Installment-Based Cash Advance Plans

The bright side? There are ways out. You do not need to keep tossing money into a great void. You can break cost-free-- however it takes a strategy.

1. Face the Numbers Head-On

I recognize. Considering the hard numbers may be the last thing you want to do. But to venture out, you need to understand exactly where you stand.

Figure out your complete balance, including interest and costs.

Consider your lending terms-- exists a fine for very early payment?

Track just how much you're really paying in rate of interest versus principal every month.

This can be painful, but expertise is power. The even more you comprehend your scenario, the far better you can fight back.

2. Stop the Cycle-- Take Into Consideration a Legal Financial Debt Resolution Program

Debt settlement companies will certainly assure the globe, but several simply take your cash without really taking care of the trouble. A lawful financial obligation resolution program is different.

These programs function within the law to:

✅ Discuss lower settlements, decreasing what you in fact owe

✅ Stop hostile collection calls and harassment

✅ Supply lawful protection, so you're not left prone

The ideal program will not simply change your financial debt around-- it will really help you move toward genuine economic freedom. Start your financial obligation resolution process today.

3. Change Your Emphasis to Long-Term Financial Stability

Escaping an installment-based lending is just the start. To make certain you never wind up below once again, you require a plan for what follows.

Display your debt to track your progression as you get out of financial obligation.

Construct a tiny emergency fund, even if it's just $20 a paycheck.

Discover just how to recognize aggressive lending institutions so you never come under their trap once more.

This isn't around just managing-- it has to do with making certain you never feel this stuck once again.

The First Step Toward Freedom

Today, it could really feel impossible. Like regardless of exactly how tough you try, the financial debt won't budge. But here's what I need you to bear in mind: this is temporary.

You are not your debt. You are not caught forever. There is a way onward, even if it does not feel like it now.

The first step? Getting actual help. A plan tailored to your needs. Lawful defense. A course towards financial liberty.

Begin your Financial Independence customized debt relief program today.

This doesn't have to define you. The weight can be lifted. The cycle can be broken. You simply need to take that first step.

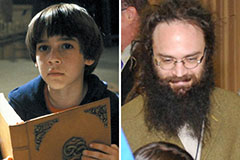

Barret Oliver Then & Now!

Barret Oliver Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!